The accountability report consists of 4 sections.

This explains our governance structures and how they support us to achieve our objectives. It includes the directors report, statement of accounting officer’s responsibilities, and our annual governance statement.

The remuneration and staff report explains the pay of Board members, independent members and senior employees that Parliament and other users see as key to accountability. It also includes details on staff costs, sickness, and our equality, diversity and inclusion data.

Parliamentary accountability and audit report

The key parliamentary accountability documents in the annual report and accounts.

Certificate and report of the Comptroller and Auditor General to the Houses of Parliament

Corporate governance report

Directors’ report

The HRA is a non-departmental public body, established in accordance with the Care Act 2014 and sponsored by the Department of Health and Social Care (DHSC).

Our relationship with DHSC, acting on behalf of the Secretary of State, is regulated by a Framework Agreement. This sets out:

- the respective roles and responsibilities of each organisation

- the shared principles that underpin our relationship

- the arrangements for ensuring DHSC can fulfil its responsibilities This agreement also explains our governance arrangements, how we are

accountable for our performance and how DHSC measures our performance without being involved in our day-to-day decision making.

The DHSC’s Science, Research and Evidence Directorate acts as our sponsor and provides assurance to the DHSC Permanent Secretary and the Secretary of State that we are meeting our obligations.

Where relevant the HRA is fully compliant with the principles around governance best practice for public service as set out in ‘Corporate governance in central government departments: code of good practice 2017’.

We are governed by a Board that is our corporate decision-making body.

The Board gives strategic oversight, agrees high-level policy, and ensures the HRA is run effectively and efficiently.

In accordance with schedule 7 of the Care Act 2014, the Board comprises the chair, 4 non-executive directors and 3 executive directors including the chief executive. 2 directors attend the Board as non-voting members.

The membership of the Board has changed in year with Professor Sir Terence Stephenson, Chair and Richard Cooper, Non-Executive Director leaving the Board in January 2025. The HRA also had 1 non-executive director vacancy with 3 new Non-Executive Directors joining the Board from February 2025 onwards.

Biographies and declarations of interest of all our Board members are available on our website.

HRA Board membership

Professor Sir Terence Stephenson

Chair of Board, Chair of Pay and Remuneration Committee, Non-Executive Director

1 Sept 2019 – 31 January 2025

Professor Stephenson left the HRA on 31 January 2025.

Richard Cooper

Chair of Audit and Risk Committee, Non-Executive Director

1 February 2019 – 31 January 2025

Richard Cooper left the HRA on 31 January 2025.

Professor Andrew George

Chair of Audit and Risk Committee, Co-Chair of Community Committee, Non-Executive Director

1 January 2019 – present

Professor George became Chair of the Audit and Risk Committee on 1 February 2025.

Neelam Patel

Interim Chair, Non-Executive Director

1 April 2021 – present

Neelam Patel became interim Chair of the HRA on 1 February 2025.

Mark Buswell

Non-Executive Director

1 February 2025 – present

Mark Buswell joined the HRA on 1 February 2025

Professor Alastair Denniston

Non-Executive Director

1 February 2025 – present

Professor Denniston joined the HRA on 1 February 2025

Professor Marian Knight

Non-Executive Director

1 February 2025 – present

Professor Knight joined the HRA on 1 February 2025

Matt Westmore

Chief Executive, Executive Director

22 February 2021 – present

Karen Williams

Deputy Chief Executive and Director of Resources, Executive Director

5 January 2017 – present

Janet Messer

Director of Approvals, Executive Director

15 September 2014 – present

Becky Purvis

Director of Policy and Partnerships, Director who attends the Board

27 June 2022 – present

Julie Waters

Chief Digital Transformation Officer, Director who attends the Board

1 August 2022 – present

We are committed to openness and transparency with our Board meetings, which are held in public with all the papers and minutes available on our website.

The Board monitors performance every 3 months by reviewing performance reports. These reports enable the Board to scrutinise performance against agreed metrics, check progress in delivering our business plan and change portfolio, and examine our financial performance and strategic risk register. The Board meets twice a year in private with the purpose of considering the HRA’s future strategic direction. Our reporting also includes an assessment of progress made in achieving our strategy.

The Board is supported by 3 sub-committees:

- the Audit and Risk Committee

- the Pay and Remuneration Committee

- the Community Committee

Audit and Risk Committee

This committee advises the Accounting Officer and Board on risk management, corporate governance, and assurance arrangements. It comprises 3 non- executive directors and 2 independent members. Individuals from the HRA and Government Internal Audit Agency are invited and regularly attend the committee. The National Audit Office, as external auditors for the HRA, also attend each meeting.

Pay and Remuneration Committee

This committee makes decisions on senior executive salaries, their performance related pay and other terms and conditions. It also reviews arrangements for termination of employment, including termination payments. It is made up of the Chair of the Board and 4 non-executive directors.

Community Committee

We understand it is important to listen to and involve a diverse group of people in our work, to better reflect the society that we serve and increase their involvement in the decisions that we make. This committee has responsibility for supporting the HRA’s strategy to make it easy to do research that people can trust, and advises the Board on any issues, developments, proposals or policies which may impact on our community.

It comprises 1 non-executive director and 11 members of the HRA Community

- 4 members of Research Ethics Committees, 1 member of the Confidentiality Advisory Group and 6 members of the public. Biographies of Community Committee members can be found on our website.

Executive Committee

The Executive Committee is not a formal sub-committee of the Board, but its members are accountable to it. It is the senior executive decision-making body responsible for managing our business within agreed objectives, funding, and our Framework Agreement. The Executive Committee is accountable to the Chief Executive. It is chaired by the Chief Executive and has 11 members. It is responsible for ensuring an effective connection between executive to Board business and the formulation of HRA strategy.

The Executive Committee has delegated responsibility to individual directors for the management of day-to-day organisational business, and to the Portfolio Delivery

Group for the management of the HRA’s change activities. These are within agreed objectives, funding, and according to the HRA/DHSC Framework Agreement and standing orders.

HRA Board and sub-committee attendance

| Name | Role | Board | Audit and Risk Committee | Pay and Remuneration Committee |

|

Professor Sir Terence Stephenson |

Non-Executive Director | 3/3 | 1/1 | |

| Richard Cooper | Non-Executive Director | 2/3 | 4/4 | 1/1 |

| Professor Andrew George | Non-Executive Director | 4/4 | 5/5 | 1/1 |

| Neelam Patel | Non-Executive Director | 4/4 | 5/5 | 1/1 |

| Mark Buswell | Non-Executive Director | 1/1 | ||

| Professor Alastair Denniston | Non-Executive Director | 1/1 | ||

| Professor Marian Knight | Non-Executive Director | 1/1 | ||

| Dr Janet Messer | Executive Director | 4/4 | ||

| Becky Purvis | Director who attends the Board | 4/4 | ||

| Julie Waters | Director who attends the Board | 4/4 | ||

| Matt Westmore | Executive Director | 4/4 | ||

| Karen Williams | Executive Director | 4/4 | ||

| Nick Longhurst (from 1 June 2023) |

Independent member of Audit and Risk Committee |

4/5 | ||

| George Ritchie |

Independent member of Audit and Risk Committee |

4/5 |

Highlights of Board meetings in 2024-25

During 2024-25 the Board and its committees considered key strategic issues and routine business planning. The topics considered included:

- performance reports, including finance reports, updates on change portfolio dashboard and improvement activities, strategic and key operational risks and risk appetite for the organisation

- updates from the Audit and Risk Committee and Community Committee

- feedback from Staff Voices representatives on staff-related matters

- Research Ethics Service in England annual report

- Confidentiality Advisory Group annual report

- annual staff survey findings report and action plan

- complaints annual report

- positive changes arising from Equality Impact Assessments

- reviewing an updated Framework Agreement with the Department of Health and Social Care

- HRA commercial strategy

- HRA’s modern slavery statement

- our achievements and key messages for stakeholders

- Board effectiveness review

The Board improves its performance and effectiveness through seminars and strategic sessions. During 2024-25 these included:

- update on progress of our Strategy

- understanding cyber risks for the HRA

- plans for developing our next Strategy

- business planning and priorities

- understanding the possible impact of the comprehensive spending review on the HRA and the Research Systems Programme

- a joint seminar with key stakeholders to consider how the HRA and others can collectively support the Government’s health and growth missions and the NHS 10-year plan

- a joint seminar on ways of working with the HRA’s Community Committee

- Board ways of working and effectiveness with new members

Summary of the Board effectiveness review

The findings from the most recent internally facilitated Board effectiveness review were received at the May 2025 Board meeting. The Board concluded the requirements of the Code of Good Practice for Corporate Governance, where relevant for the HRA as a Non-Departmental Government Body, are being met and the required responsibilities are being suitably carried out. Several opportunities to improve the effectiveness of the Board were identified, including supporting board succession planning and further work on horizon scanning to develop the forward planner of strategic seminars, which have been addressed during the year. A light touch review of the effectiveness of the Board was undertaken in March 2025. As the membership of the Board changed considerably in February 2025, with 2 non-executive directors leaving and 3 new non-executive directors joining the Board, the review focused on how the Board can operate most effectively with the new membership. The review included:

- ensuring the balance between the Board’s strategic direction role and assurance role is appropriate

- the quality of the papers and discussion and ensuring non-executive Directors could input at the appropriate time

- the relationships between Board members, in particular how non-executive directors and the Executive Committee members interact outside of Board meetings.

Statement of Accounting Officer’s responsibilities

Under the Care Act 2014, Section 109 (Schedule 7, paragraphs 19 and 20) the Secretary of State has directed the HRA to prepare a financial statement of accounts for each year in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of the HRA and of its income and expenditure, statement of financial position, and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual issued by HM Treasury and in particular to:

- observe the Accounts Direction issued by the Secretary of State, with the approval of HM Treasury, including the relevant accounting and disclosure requirements and apply suitable accounting policies on a consistent basis

- make judgements and estimates on a reasonable basis

- state whether applicable accounting standards as set out in the Government Financial Reporting Manual have been followed and disclose and explain any material departures in the accounts

- prepare the accounts on a going concern basis

- confirm that the annual report and accounts as a whole is fair, balanced and understandable

- confirm that the Accounting Officer takes personal responsibility for the annual report and accounts and the judgements required for determining that it is fair, balanced and understandable

The Accounting Officer for DHSC has appointed the Chief Executive as Accounting Officer for the HRA.

The responsibilities of an Accounting Officer are set out in Managing Public Money published by the HM Treasury. These include responsibility for the propriety and regularity of the public finances, for keeping proper records and for safeguarding HRA’s assets.

As far as the Accounting Officer is aware, there is no relevant audit information of which the entity’s auditors are unaware and the Accounting Officer has taken all the steps that they ought to have taken to make them aware of any relevant audit information and to establish that the entity’s auditors are aware of that information.

Governance statement

Risk management system

We want to make the most impact from our operations within our available resources. An effective risk management system supports this without stopping innovation. This requires considering a full cross section of risks we face including reputational risks, financial risks, organisational risks, health and safety risks and risks to the achievement of the organisation’s objectives.

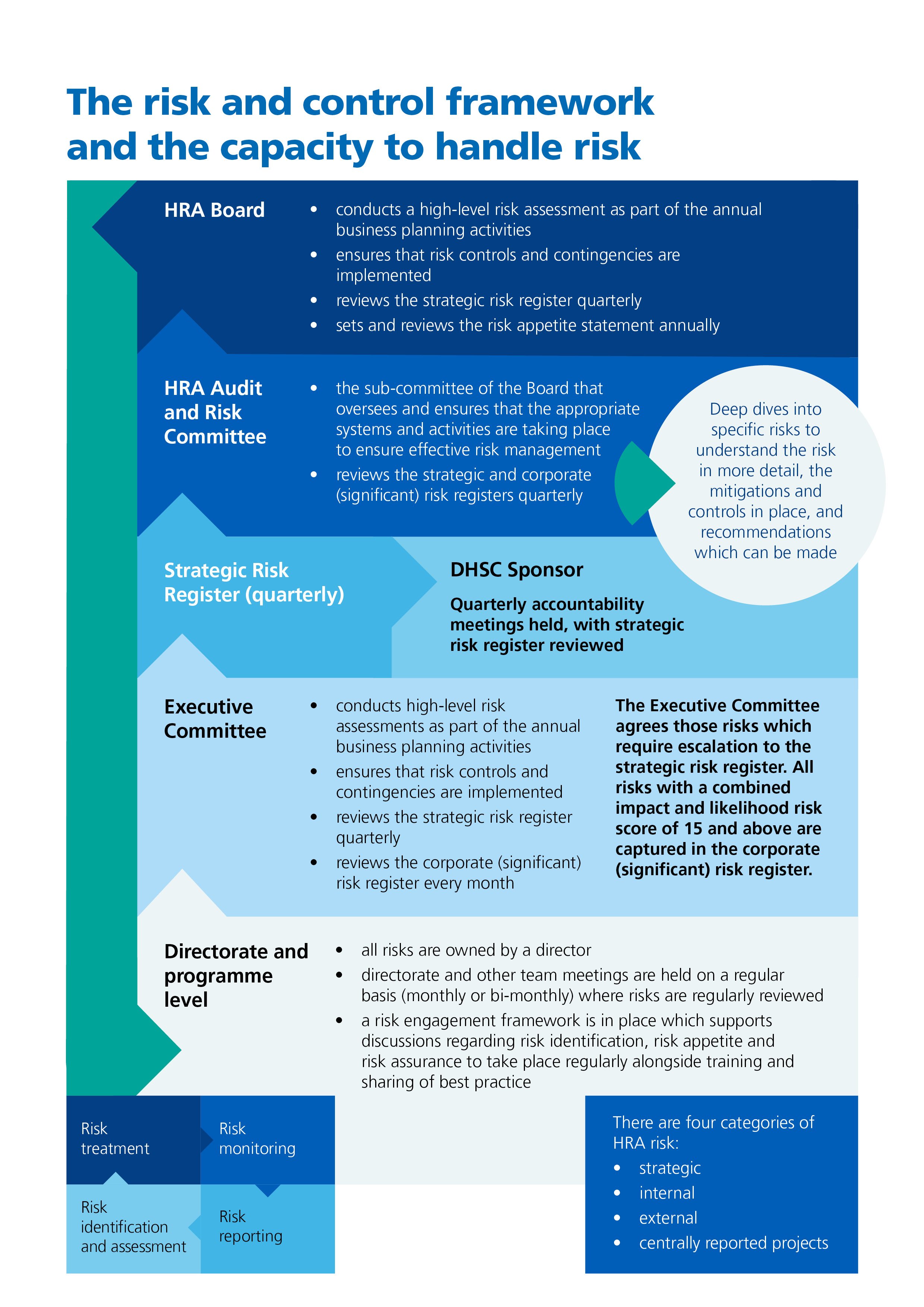

There are 4 types of risk managed by the organisation:

- Internal: these are risks which we have some ability to control and are predominantly managed through the directorate risk registers

- External: these are big external events or perils and are captured in our threat assessment.

- Strategic: these risks relate to our key strategic objectives and are captured in the strategic risk register.

- Centrally reported projects: these risks relate to our change activities and include our most critical projects and programmes.

The HRA risk management framework ensures that the Board receives regular reports on the Strategic risks. Any significant risks are captured on the Corporate Risk Register and escalated to the Audit and Risk Committee and Executive Committee for discussion, and the HRA Board and DHSC sponsor team as required. The risk engagement framework supports our risk management culture by:

- sharing the risk appetite from the Board with staff and looking at what assurance is in place to address key risks affecting the organisation

- ensuring there is appropriate risk related training for staff

- sharing of feedback and good practice throughout the year

Risk management delegated responsibilities

All staff have a role to play in managing risk throughout the HRA. We make sure staff can perform their role through providing relevant information, guidance and training.

| Activity | Responsible |

|

Overall responsibility for our risk management policy and assigning a responsible senior manager for risk management |

HRA Board |

|

Ensuring risk management processes are effective and embedded throughout our work |

HRA Board |

| Agreeing our risk appetite statement |

HRA Board |

| Reviewing significant programme, project, strategic and operational risks |

HRA Board |

|

Reviewing critical risk management activities including confirming the effectiveness of controls |

HRA Board |

|

Ensuring appropriate risk management systems are in place |

Chief Executive |

|

Regular review and follow up of processes including confirming the effectiveness of controls |

Company Secretary |

|

Ensuring the appropriate risk governance structure is in place |

Company Secretary |

Our risk management systems have been in place for the year under review and up to the date of approval of the annual report and accounts. In addressing issues relating to risk, we seek to be as transparent and open as possible. We identify and address those areas where there is a need for improvement in the risk management processes or controls and contingencies.

The internal audit function forms part of the review process and provides assurance on the risk management process and advises the Audit and Risk Committee and Accounting Officer.

Information governance

The HRA has an established information governance structure:

- the Board has designated the Deputy Chief Executive and Director of Resources as Senior Information Risk Officer (SIRO) with responsibility for the system of safeguarding and protecting personally identifiable, confidential, and sensitive data

- the information governance lead is also the Deputy Chief Executive and Director of Resources

- Jonathan Fennelly-Barnwell, Deputy Director of the Approvals Service is the Caldicott Guardian

- Stephen Tebbutt, Company Secretary is the Data Protection Officer

- directors and senior managers are Information Asset Owners (IAOs) as appropriate

The Information Governance Steering Group (IGSG) is a formal sub-committee of the Executive Committee. Its purpose is to coordinate, supervise and review the work of others to make sure we maintain a coordinated approach to information governance. It meets 4 times a year and puts in place assurance processes that consider information governance issues to enable continuous improvement.

Data security risks are managed and monitored within the overall risk management framework, the HMG Security Policy Framework, overseen by the information governance lead and IGSG to ensure security threats are followed up and appropriately managed. We are committed to the 10 steps to cyber security and the National Data Guardian’s Data Security Standards.

No data security incidents have been reported to the Information Commissioner's Office (ICO) during the year.

The IGSG meets quarterly to receive assurance that cyber security controls are sufficient to prevent information security threats.

All information assets and associated systems are identified and included in our Information Asset Register and are assessed annually. These assessments inform the Corporate and Information Risk Registers and help ensure we conform to data protection legislation.

We have also completed the Data Security and Protection Toolkit this year and met all mandatory requirements.

The system of internal control

As Accounting Officer, I have responsibility for reviewing the effectiveness of the system of internal control, which has been in place for the year 1 April 2024 to 31 March 2025 and up to the date of approval of the annual report and accounts, in accordance with HM Treasury guidance.

The Executive Committee, which I lead, reviews and monitors progress with other management groups providing input as required. These include Portfolio Delivery Group, Recruitment Panel and Digital Strategy and Prioritisation Group.

Senior managers who have responsibility for the development and maintenance of the system of internal control provide me with assurance. The assurance framework itself provides me with evidence that the effectiveness of controls that manage the risks to the organisation achieving its principal objectives have been reviewed and this aspect of our activities has been subject to external review.

Our business plan is developed and approved by the Board and sets out our clear purpose and business objectives to deliver our strategy and statutory functions.

Our controls assurance and risk management processes are closely aligned to the twin objectives of maintaining ongoing activities and managing significant transformation activities.

Reports are provided to the Board every 3 months on achievements and progress against the objectives and plans, and these reports include risks and controls in place to mitigate them.

The effectiveness of the system of internal control is reviewed by our internal auditors who plan and carry out a workplan approved by the Audit and Risk Committee. When weaknesses are identified, these are reported to the Audit and Risk Committee and an action plan agreed with management to address these. This year an improvement to the timely completion of action plans has been seen following the maturement of a robust process for monitoring and tracking recommendations through the year.

6 internal audit reviews were performed, 4 assurance audits and 2 advisory audits. 3 assurance audits opinions were rated Moderate, and 1 was rated as substantial compared to all 4 rated Moderate in 2023-24. The assurance audits focused on health and safety, budget management, technical assurance and the data security and protection toolkit. The advisory audits focused on functional standards and capacity and capability. Recommendations from these audits are being actively monitored and implemented in line with agreed plans. The audits identified several areas where planning could be enhanced to ensure completion of tasks to improve the control environment.

Our internal auditors attend Audit and Risk Committee to keep informed of the design and operation of the systems of internal control. The Head of Internal Audit

provides me with an opinion, in accordance with Public Sector Internal Audit Standards, on the overall adequacy and effectiveness of the HRA’s risk management, control and governance processes.

Head of Internal Audit opinion 2024-25

In accordance with the requirements of the UK Public Sector Internal Audit Standards, I am required to provide the Accounting Officer and the Audit and Risk Committee with my annual opinion of the adequacy and effectiveness of the organisation’s risk management, control and governance processes. My opinion is a key element of the assurance framework and can be used to inform the organisation’s Governance Statement; however, the Accounting Officer retains personal responsibility for risk management, governance and control processes.

My annual internal audit opinion reflects the audit plan agreed and is not limited in scope, to the extent that the assurance provided by internal audit can never be absolute.

My opinion is based on the governance, risk and control frameworks set out in the following publications, which apply to central government organisations:

- Corporate governance code for central government departments (2017), the Code is mandatory for departments, advisory for other bodies

- Orange Book: Management of risks – principles and concepts (2023)

- Managing Public Money (2021)

I am providing an overall Moderate opinion on the framework of governance, risk management and control within the HRA for the year-ended 31 March 2025. Overall governance, risk management and control arrangement are generally effective. The improvements points highlighted in my report are about clarifying roles and responsibilities and by further developing processes.

Declaration of interests

The HRA maintains a formal register of Board members’ interests as set out in the Code of Accountability for the NHS.

Board members are asked to confirm any declarations of interest at each Board meeting and at any time that changes take place. This includes any interests in relation to specific items on the Board agenda. Board members are also asked to declare any spouse or partner interests. The register, showing current declarations made by the Board, is updated on a regular basis and made available to the public at www.hra.nhs.uk/about-us/governance/ publication-scheme/list-and-registers/

Remuneration to auditors

The accounts have been prepared according to accounts direction of the Secretary of State, with approval of HM Treasury. The accounts have been audited by the Comptroller and Auditor General under the Care Act 2014 at the cost of £72,100 (2023-24 £60,000). The audit certificate can be found on page 66.

Functional standards

We must apply and adhere to the UK Government functional standards in our processes and services. These standards help create a coherent, effective and mutually understood way of doing business within public bodies. They provide a stable basis for assurance, risk management and capability improvement. In 2023-24 we have embedded functional standards across most areas and in 2024-25 we introduced enhanced quarterly monitoring of continuous improvement activities for these standards

The Executive Committee has identified several standards which either do not apply to the HRA or have been deemed disproportionate to the size and scale of the HRA. For example, functional standard GOV003 Human Resources applies to organisations where civil servants are employed. As HRA staff are not civil servants this standard does not apply however the HRA has committed to incorporating any relevant best practice into our ways of working when the HRA People Strategy is next reviewed. A review of the standards which are deemed disproportionate will be undertaken annually to ensure this decision is kept under review. Further work is required to embed and report on 2 of the standards which will continue into 2025-26.

Compliance with NHS Pension Scheme regulations

As an employer with staff entitled to membership of the NHS Pension Scheme, control measures are in place to ensure all employer obligations contained within the scheme regulations are complied with. This includes ensuring that deductions from salary, employer contributions and payments into the scheme are in accordance with the scheme rules and that member pension scheme records are accurately updated in accordance with the timescales detailed in regulations.

Renumeration and staff report

Remuneration Policy

The Chair and Non-Executive Director Board members are remunerated in line with DHSC guidance that applies to all NHS bodies. Details of the senior managers’ remuneration, given in the following tables, are set and reviewed in line with DHSC guidance Pay Framework for Executive and Senior Managers (ESM) in Arm’s Length Bodies.

Senior managers employed under the ESM framework are under stated contracts of employment on terms and conditions as set out by NHS employers. All those contained in the senior managers’ remuneration table below are subject to annual appraisals on their performance.

The HRA does not make performance pay or bonus payments to staff on agenda for change terms and conditions. Staff employed on executive and senior managers (ESM) contracts can be awarded non-consolidated performance related pay award at the discretion of the Pay and Renumeration Committee. Details of these payments can be found in the remuneration report.

Remuneration and pension for Directors (subject to audit):

Remuneration of Chair and Non-Executive Directors

| Name |

Year ended 31 March |

Salary (bands of £5,000) |

Taxable expense payments(1) (to nearest £100) |

Total (bands of £5,000) |

| £000 | £ | £000 | ||

| Professor Sir Terence Stephenson (2) Chair | 2025 | 35 to 40 | 0 | 35 to 40 |

| 2024 | 45 to 50 | 0 | 45 to 50 | |

| Neelam Patel (3) Interim Chair | 2025 | 10 to 15 | 0 | 10 to 15 |

| 2024 | 5 to 10 | 0 | 5 to 10 | |

| Dr Mark Buswell (4) | 2025 | 0 to 5 | 0 | 0 to 5 |

| 2024 | 0 | 0 | 0 | |

| Richard Cooper (5) | 2025 | 10 to 15 | 300 | 10 to 15 |

| 2024 | 10 to 15 | 300 | 10 to 15 | |

| Professor Alastair Denniston (4) | 2025 | 0 to 5 | 0 | 0 to 5 |

| 2024 | 0 | 0 | 0 | |

| Professor Andrew George | 2025 | 5 to 10 | 0 | 5 to 10 |

| 2024 | 5 to 10 | 0 | 5 to 10 | |

| Professor Marian Knight (4) | 2025 | 0 to 5 | 0 | 0 to 5 |

| 2024 | 0 | 0 | 0 | |

| Dr Nicole Mather (6) | 2025 | 0 | 0 | 0 |

| 2024 | 0 to 5 | 0 | 0 to 5 |

The Chair and Non-Executive Directors are not eligible for membership of the HRA's Pension Schemes and therefore no Pension Related Benefits column has been included in the table above. No performance related pay awards or bonuses were made to the Chair or Non-Executive Directors in 2024-25 or 2023-24.

(1) The Taxable expenses payments represent the monetary value of commuting expenses claimed and reimbursed during the year.

(2) Professor Sir Terence Stephenson was employed as Chair until 31 January 2025. His full year equivalent salary to 31 March 2025 was between £45,000 and £50,000. He was not paid directly by the HRA. His salary was paid by University College London and then recharged to the HRA on a cost-recovery basis.

(3) Neelam Patel, is employed as a Non-Executive Director and was appointed as Interim Chair from 1 February 2025 whilst the recruitment process for a permanent Chair is undertaken.

(4) Dr Mark Buswell, Professor Alastair Denniston and Professor Marian Knight were appointed as Non-Executive Directors from 1 February 2025 on initial 3year terms. Their full year equivalent salaries to 31 March 2025 were all between £5,000 and £10,000.

(5) Richard Cooper was employed as a Non-Executive Director until 31 January 2025. His full year equivalent salary to 31 March 2025 was between £10,000 and £15,000.

6) Dr Nicole Mather was employed as a Non-Executive Director until 31 July 2023. Her full year equivalent salary for the year ending 31 March 2024 was between £5,000 and £10,000.

Remuneration of Directors

| Name |

Year ended 31 March |

Salary (bands of £5,000) |

Taxable expense payments (1) (to nearest £100) |

Performance pay and bonuses (bands of £5,000) |

Pension related benefits (2) (to nearest £1,000) |

Total (bands of £5,000) |

| £000 | £ | £000 | £000 | £000 | ||

| Dr Matthew Westmore | 2025 | 145 to 150 | 1,000 | 0 | 36 | 185 to 190 |

| Chief Executive | 2024 | 140 to 145 | 400 | 0 | 40 | 180 to 185 |

| Dr Janet Messer (3) | 2025 | 105 to 110 | 0 | 0 | 19 | 125 to 130 |

|

Director of Approvals Service |

2024 | 100 to 105 | 0 | 0 | 0 | 100 to 105 |

| Becky Purvis | 2025 | 100 to 105 | 0 | 0 | 26 | 125 to 130 |

|

Director of Policy and Partnerships |

2024 | 95 to 100 | 0 | 0 | 23 | 115 to 120 |

| Julie Waters (4) | 2025 | 100 to 105 | 0 | 0 to 5 | 30 | 135 to 140 |

|

Chief Digital Transformation Officer |

2024 | 95 to100 | 0 | 0 | 41 | 135 to 140 |

| Karen Williams | 2025 | 130 to 135 | 0 | 0 | 38 | 170 to 175 |

|

Deputy Chief Executive and Director of Resources |

2024 | 125 to 130 | 0 | 0 | 34 | 160 to 165 |

(1) The Taxable expenses payments represent the monetary value of benefits treated by HMRC as a taxable emolument, provided by the HRA. Dr Matthew Westmore has a lease car provided through a non-subsidised salary sacrifice scheme that is open to all permanent HRA staff including Directors.

(2) Pension benefits accrued during the year are calculated on the real increase in pension multiplied by 20, less the contributions made by the individual. The real increase excludes increases due to inflation that will be received by the individual. It is a calculation that is intended to convey to the reader of the accounts an estimation of the benefit that being a member of the pension scheme could provide. The pension benefit table provides further information on the pension benefits accruing to the individual.

(3) Dr Janet Messer is affected by the Public Service Pensions Remedy. Accrued pension benefits included in this table have been calculated based on their inclusion in the legacy scheme for the period between 1 April 2015 and 31 March 2022, following the McCloud judgment. The Public Service Pensions Remedy applies to individuals that were members, or eligible to be members, of a public service pension scheme on 31 March 2012 and were members of a public service pension scheme between 1 April 2015 and 31 March 2022. The basis for the calculation reflects the legal position that impacted members have been rolled back into the relevant legacy scheme for the remedy period and that this will apply unless the member actively exercises their entitlement on retirement to decide instead to receive benefits calculated under the terms of the Alpha scheme for the period from 1 April 2015 to 31 March 2022.

(4) During 2024-25 the Pay and Remuneration Committee approved a 5 per cent non-consolidated performance related pay award to Julie Waters in recognition of work undertaken on the Research Systems programme. No performance related pay awards or bonuses payments were made to the Directors in 2023-24.

Pension Benefits of Directors

| Name |

Real Increase in pension at pension age (bands of £2,500) |

Real increase in pension lump sum at pension age (bands of £2,500) |

Total accrued pension at pension age at 31 March 2025 (bands of £5,000) |

Accrued related lump sum at pension age at 31 March 2025 (bands of £5,000) |

| £000 | £000 | £000 | £000 | |

| Dr Matthew Westmore, Chief Executive | 2.5 to 5 | 0 | 10 to 15 | 0 to 5 |

|

Dr Janet Messer (1) Director of Approvals Service |

0 to 2.5 | 0 | 30 to 35 | 70 to 75 |

| Becky Purvis Director of Policy and Partnerships | 0 to 2.5 | 0 | 5 to 10 | 0 |

| Julie Waters Chief Digital Transformation Officer | 0 to 2.5 | 0 | 15 to 20 | 5 to 10 |

| Karen Williams Deputy Chief Executive and Director of Resources | 2.5 to 5 | 0 | 20 to 25 | 0 |

The Chair and Non-Executive Directors are not eligible for membership of the HRA's Pension Schemes and therefore no figures are included for them in the table above.

Negative values are not disclosed in this table but are substituted with a zero.

(1) Dr Janet Messer is affected by the Public Service Pensions Remedy. Accrued pension benefits included in this table have been calculated based on their inclusion in the legacy scheme for the period between 1 April 2015 and 31 March 2022, following the McCloud judgment. The Public Service Pensions Remedy applies to individuals that were members, or eligible to be members, of a public service pension scheme on 31 March 2012 and were members of a public service pension scheme between 1 April 2015 and 31 March 2022. The basis for the calculation reflects the legal position that impacted members have been rolled back into the relevant legacy scheme for the remedy period and that this will apply unless the member actively exercises their entitlement on retirement to decide instead to receive benefits calculated under the terms of the Alpha scheme for the period from 1 April 2015 to 31 March 2022.

(2) A Cash Equivalent Transfer Values (CETV) is the actuarially assessed capital value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s (or other allowable beneficiary’s) pension payable from the scheme. CETVs are calculated in accordance with SI 2008 No.1050 Occupational Pension Schemes (Transfer Values) Regulations 2008.

(3) The real increase in CETV reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation or contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement).

Fair Pay (subject to audit)

Pay Ratio Information

Reporting bodies are required to disclose the relationship between the remuneration of the highest paid director in their organisation against the 25th percentile, median and 75th percentile of remuneration of the organisation’s workforce. Total remuneration is further broken down to show the relationship between the highest paid director's salary component of their total remuneration against the 25th percentile, median and 75th percentile of salary components of the organisation’s workforce.

In 2024-25, the banded annualised total remuneration of the highest paid director was £150,000 to £155,000 (2023-24, £140,000 to £145,000) and the banded salary of the highest paid director was £145,000 to £150,000 (2023-24, £140,000 to £145,000). The relationship to the remuneration of the organisation’s workforce is disclosed in the below table.

Pay ratio table

|

Highest paid director mid-point |

2024-25 | 2023-24 |

| Total remuneration | £152,500 | £142,500 |

| Salary | £147,500 | £142,500 |

| 25th Percentile | 2024-25 | 2023-24 |

| Total remuneration | £36,483 | £34,581 |

|

Total remuneration ratio |

4.2:1 | 4.1:1 |

| Salary | £36,483 | £34,581 |

| Salary ratio | 4.0:1 | 4.1:1 |

| Median (50th Percentile) | 2024-25 | 2023-24 |

| Total remuneration | £44,962 | £42,618 |

|

Total remuneration ratio |

3.4:1 | 3.3:1 |

| Salary | £44,962 | £42,618 |

| Salary ratio | 3.3:1 | 3.3:1 |

| 75th Percentile | 2024-25 | 2023-24 |

| Total remuneration | £52,809 | £50,056 |

|

Total remuneration ratio |

2.9:1 | 2.8:1 |

| Salary | £52,809 | £50,056 |

| Salary ratio | 2.8:1 | 2.8:1 |

All percentile values are showing an increase from last year. The median total remuneration has increased by 5.5 per cent to £44,962 and the median salary has increased by 5.5 per cent to £44,962. These increases are in line with the 5.5 per cent consolidated pay award for staff employed on agenda for change contracts. The median total remuneration and salary values for both years is the top pay point of the agenda for change band 6.

The total remuneration and salary percentile ratios are largely consistent with last year. The median total remuneration ratio has increased by 3.0% to 3.4:1 and the median salary ratio has remained at 3.3:1. The increase in median total remuneration ratio is due to the highest paid director's total remuneration value rounding up to a higher banding mid-point in 2024-25. For 2024-25 all staff employed on agenda for change contracts have received a pay award of 5.5 per cent and staff employed on executive and senior managers (ESM) contracts have received a pay award of 5 per cent and the movements in percentile ratios are considered consistent with these pay awards.

The median pay ratio is considered consistent with the pay, reward, and progression policies of the organisation for the employees taken as a whole.

Remuneration range

Total remuneration includes salary, non-consolidated performance-related pay and benefits-in-kind, but not severance payments. It does not include employer pension contributions and the cash equivalent transfer value of pensions. Total banded remuneration for 2024-25 ranged from £20,000 to £25,000 up to £150,000 to £155,000 (2023-24 £20,000 to £25,000 up to £140,000 to £145,000). No substantive employees received remuneration more than the highest paid director during 2024-25 or 2023-24. During 2024-25 one individual received annualised equivalent remuneration greater than the highest paid director. This individual was engaged via an agency to provide specialist skills and capabilities for the Research Systems programme. Approval for this arrangement was provided by DHSC through a Professional Services Business Case.

Salary and allowances

| Percentage change from the previous financial year | 2024-25 | 2023-24 |

|

Highest paid Director |

3.5% | 3.6% |

|

All employees (excluding highest paid Director) |

8.9% | 7.5% |

Highest paid Director

The percentage increase in the highest paid Director’s remuneration for 2024-25 is due to the 5 per cent consolidated pay award to staff employed on executive and senior managers (ESM) contracts. The increase shown is lower than the full 5 per cent pay award due to the calculation using the mid-point of the salary banding rather than the actual salary.

All employees (excluding highest paid Director)

The average percentage increase in all employees (excluding highest paid Director) salary and allowances for 2024-25 is mainly due to the 5 per cent consolidated pay award for staff employed on executive and senior managers (ESM) contracts and 5.5 per cent consolidated pay award for staff employed on agenda for change contracts. Changes in the composition and distribution of the pay banding of the workforce during 2024-25, coupled with incremental pay progression has led to a greater average per cent increase in year than the 5.5 per cent pay award.

Performance pay and bonuses

|

Percentage change from the previous financial year in respect of: |

2024-25 | 2023-24 |

|

Highest paid Director |

0.0% | 0.0% |

|

All employees (excluding highest paid Director) |

Undefined | -100.0% |

Highest paid Director

No non-consolidated performance related pay awards were made to the highest paid Director in 2024-25 or 2023-24.

All employees (excluding highest paid Director)

Staff employed on executive and senior managers (ESM) contracts can be awarded non-consolidated performance related pay award at the discretion of the Pay and Remuneration Committee. Details of these payments can be found in the remuneration report. One non-consolidated performance related pay award of 5 per cent (banded value of £0 to £5,000) was made in 2024-25 in recognition of work undertaken on the Research Systems programme. No performance related pay or bonuses were made in 2023-24.

Staff report

Early retirements and redundancies (subject to audit)

Redundancy and other departure costs have been paid in accordance with agenda for change terms and conditions.

The table below shows the total cost of exit packages agreed and accounted for in 2024-25 and 2023-24. The amounts are due to the individuals and do not include any employers’ National Insurance contribution. These payments are included within the social security costs in the staff note. Additional costs of agreed early retirement are met by the HRA and not by the NHS Pension Scheme. Ill health retirement costs are met by the NHS pension scheme and are not included in this table. There are no redundancy payments that are special payments.

12 exit packages were agreed during the year, costing £381,223 (2023-24; 3, £78,616).

Of the total £359,886 compulsory redundancies agreed, £182,768 was paid during the year to staff who left prior to the 31 March 2025 (2023-24: £18,616). £177,118 relates to payments to be made after 1st April 2025. There were 3 other departure costs agreed and paid in 2024-25 £21,336 (2023-24 £0)

Exit packages for year ended 31 March 2025

| Exit package cost band | Number of compulsory redundancies | Cost of compulsory redundancies | Number of other departures | Cost of other departures | Total number of exit packages | Total cost of exit packages |

| Whole numbers | £ | Whole numbers | £ | Whole numbers | £ | |

| Less than £10,000 | 0 | 0 | 2 | 5,783 | 2 | 5,783 |

| £10,001 to £25,000 | 5 | 85,373 | 1 | 15,554 | 6 | 100,927 |

| £25,001 to £50,000 | 2 | 72,426 | 0 | 0 | 2 | 72,426 |

| £50,001 to £100,000 | 1 | 60,805 | 0 | 0 | 1 | 60,805 |

| £100,001 to £150,000 | 1 | 141,282 | 0 | 0 | 1 | 141,282 |

| Totals | 9 | 359,886 | 3 | 21,336 | 12 | 381,223 |

Exit packages for year ended 31 March 2024

|

Exit package cost band |

Number of compulsory redundancies | Cost of compulsory redundancies | Number of other departures | Cost of other departures | Total number of exit packages | Total cost of exit packages |

| Whole numbers | £ | Whole numbers | £ | Whole numbers | £ | |

| Less than £10,000 | 1 | 5,878 | 0 | 0 | 1 | 5,878 |

| £10,001 to £25,000 | 1 | 12,738 | 0 | 0 | 1 | 12,738 |

| £25,001 to £50,000 | 0 | 0 | 0 | 0 | 0 | 0 |

| £50,001 to £100,000 | 1 | 60,000 | 0 | 0 | 1 | 60,000 |

| Totals | 3 | 78,616 | 0 | 0 | 3 | 78,616 |

Analysis of staff costs (subject to audit)

| Staff costs | Year ended 31 March 2025 | Year ended 31 March 2024 |

| Permanently employed | Other | |

| £000 | £000 | |

| Salaries and wages | 11,247 | 84 |

| Social security costs | 1,170 | 0 |

| Employer contributions to NHSPA | 2,465 | 0 |

| Redundancies/notice | 381 | 0 |

|

Staff costs |

15,263 | 84 |

|

Less recoveries in respect of outward secondments |

(105) | 0 |

| 15,158 | 84 |

The costs and average numbers of staff include the costs of staff employed by other organisations that are recharged to the HRA. These are included within the 'other' column. These figures include social security costs and employer contributions to the NHS Pensions Authority.

The average number of Full Time Equivalent (FTE) persons employed during the year (subject to audit)

| Year-end 31 March 2025 | Year-end 31 March 2025 | Year-end 31 March 2025 | Year-end 31 March 2024 | |

| Permanently employed | Other | Total | Total | |

| number | number | number | Number | |

| Total | 245 | 1 | 246 | 242 |

The average number of persons employed during the year includes 5 full time equivalents whose costs have been charged to capital projects (2023-24: 3)

Staff turnover was 12.1% during 2024-25 (2023-24: 8.2%). (Unaudited)

Retirements due to ill health

This note discloses the number and additional pension costs for individuals who retired early on ill-health grounds during the year. There were no such retirements in the year to 31 March 2025 (£nil 2023-24). This information has been supplied by NHS Pensions Authority.

Pension costs

Past and present employees are covered by the provisions of the NHS Pension Schemes. Details of the benefits payable and rules of the schemes can be found on the NHS Pensions website. Both the 1995/2008 and 2015 schemes are accounted for, and the scheme liability valued, as a single combined scheme. Both are unfunded, defined benefit schemes that cover NHS employers, GP practices and other bodies, allowed under the direction of the Secretary of State for Health and Social Care in England and Wales. They are not designed to be run in a way that would enable NHS bodies to identify their share of the underlying scheme assets and liabilities. Therefore, each scheme is accounted for as if it were a defined contribution scheme: the cost to the NHS body of participating in each scheme is taken as equal to the contributions payable to that scheme for the accounting period.

In order that the defined benefit obligations recognised in the financial statements do not differ materially from those that would be determined at the reporting date by a formal actuarial valuation, the FReM requires that “the period between formal valuations shall be 4 years, with approximate assessments in intervening years”.

An outline of these follows:

a) Accounting valuation

A valuation of scheme liability is carried out annually by the scheme actuary (currently the Government Actuary’s Department) as at the end of the reporting period. This utilises an actuarial assessment for the previous accounting period in conjunction with updated membership and financial data for the current reporting period, and is accepted as providing suitably robust figures for financial reporting purposes. The valuation of the scheme liability as at 31 March 2025, is based on valuation data as at 31 March 2023, updated to 31 March 2025 with summary global member and accounting data. In undertaking this actuarial assessment, the methodology prescribed in IAS 19, relevant FReM interpretations, and the discount rate prescribed by HM Treasury have also been used.

The latest assessment of the liabilities of the scheme is contained in the Statement by the Actuary, which forms part of the annual NHS Pension Scheme Annual Report and Accounts. These accounts can be viewed on the NHS Pensions website and are published annually. Copies can also be obtained from The Stationery Office.

The purpose of this valuation is to assess the level of liability in respect of the benefits due under the schemes (considering recent demographic experience), and to recommend the contribution rate payable by employers.

The latest actuarial valuation undertaken for the NHS Pension Scheme was completed as at 31 March 2020. The results of this valuation set the employer contribution rate payable from 1 April 2024 to 23.7% of pensionable pay. The core cost cap cost of the scheme was calculated to be outside of the 3% cost cap corridor as at 31 March 2020. However, when the wider economic situation was taken into account through the economic cost cap cost of the scheme, the cost cap corridor was not similarly breached. As a result, there was no impact on the member benefit structure or contribution rates.

The 2024 actuarial valuation is currently being prepared and will be published before new contribution rates are implemented from April 2027.

Off payroll engagements

Following the review of tax arrangements of public sector appointees published by the Chief Secretary to the Treasury on 23 May 2012, we must publish the following tables of information on our highly paid or senior off-payroll engagements.

Table 1: length of all highly paid off-payroll engagements as of 31 March 2025 earning £245 per day or greater

| Number | |

|

Number of existing engagements as of 31 March 2025 |

2 |

|

Of which number that have existed at the time of reporting: |

|

| for less than 1 year | 2 |

| for between 1 and 2 years | 0 |

| for between 2 and 3 years | 0 |

| for between 3 and 4 years | 0 |

| for 4 or more years | 0 |

We can confirm that all existing off-payroll engagements have at some point been subject to a risk-based assessment as to whether assurance is required that the individual is paying the right amount of tax and where necessary, that assurance has been sought.

Table 2: number of off-payroll engagements between 1 April 2024 and 31 March 2025 earning £245 per day or greater

| Number | |

|

Number of temporary off-payroll workers engaged between 1 April 2024 and 31 March 2025 |

2 |

| Of which number: | |

|

not subject to off-payroll legislation |

2 |

|

subject to off-payroll legislation and determined as in-scope of IR35 |

0 |

|

subject to off-payroll legislation and determined as out of scope of IR35 |

0 |

|

reassessed for compliance or assurance purposes during the year |

0 |

|

that saw a change to IR35 status following review |

0 |

worker that provides their services through their own limited company or another type of intermediary to the client will be subject to off-payroll legislation and the HRA must undertake an assessment to determine whether that worker is in-scope of Intermediaries legislation (IR35) or out-of-scope for tax purposes.

Table 3: off-payroll engagements of board members, and/or senior officials with significant financial responsibility between 1 April 2024 and 31 March 2025

| Number | |

|

Number of off-payroll engagements of Board members and/or senior officers with significant financial responsibility, during the financial year |

0 |

|

Number of individuals that have been deemed ‘board members, and/or senior officials with significant financial responsibility’ during the financial year. This figure includes both off-payroll and on-payroll engagements. |

11 |

Consultancy expenditure

For the year ended 31 March 2025 the HRA incurred no costs on consultancy (2023-34: £11,461).

Sickness absence

Statistics produced by NHS Digital – Sickness Absence Publication – based on data from the Electronic Staff Record (ESR) Data Warehouse.

|

Quarterly Sickness Absence Publication Average FTE 2024 |

Adjusted FTE days lost to sickness absence |

Average sickness days per FTE |

| 246 | 2,072 | 8.4 |

These statistics cover January 2023 – December 2024.

Employee Self Service (ESR) is the system we use for time and attendance management. It does not hold details of the normal number of days worked by each employee. Data on days lost and days available produced in reports are based on a 365-day year.

The number of Full-Time Equivalent (FTE) days lost to sickness absence has been estimated by multiplying the estimated FTE days available by the average sickness absence rate.

The average number of sick days per FTE has been estimated by dividing the estimated number of FTE-days sick by the average FTE.

Sickness absence rate is calculated by dividing the sum total sickness absence days (including non-working days) by the sum total days available per month for each member of staff)

Equality, diversity and inclusion (EDI)

We know the HRA is working at its best when our people feel they belong and are valued for who they are, and that they see this borne out in their daily experience of the organisation.

In 2024-2025, we:

- celebrated a continuing rise in disability disclosure, from 9% in 2023 to 11% in 2024 and increasing to 14% in 2025

- held learning events on chronic fatigue and hearing impairment and retained our Disability Confident Leader status for a further 3 years following external independent re-validation

- published a suite of reproductive health policy and guidance documents

- finalised and published a welcoming and supportive candidate area on our website

- launched a project to do more for race equity in our recruitment and progression, agreeing an action plan to challenge and change the way we work

Disability Confidence

We are committed to being a place where disabled people feel valued, supported and able to progress. We are proud that this has been recognized through the awarding of Disability Confident Leader status, which only two percent of organisations signed up to the scheme have achieved.

Recruitment and retention of disabled staff

Wherever possible, we offer a guaranteed interview to disabled applicants who meet the essential criteria. When we receive a very high-volume number of applicants, we may need to apply further selection criteria to ensure we offer a proportionate number of interviews to disabled applicants. Once staff join the HRA, we have lots in place to ensure our workplace and practices are accessible.

Disability support

- all policies and projects complete an Equalities Impact Assessment, to ensure we are building accessibility in at the design stage

- our Health and Accessibility Passport offers a framework to agree reasonable adjustments, which can then be carried into any role within the organisation, or easily shared if an employee’s line manager changes

- we have a central budget for reasonable adjustments and will fund up to £2,000 per person in-house, before asking employees to apply to Access to Work

- we have an agreed process for ensuring Access to Work recommendations are procured quickly

- we have a Disability Leave policy for planned and unplanned leave related to the treatment and management of a long-term health condition

- we are able to refer to Occupational Health specialists where further advice is needed

- we have an active Disability and Neurodiversity Network for staff, which has a strategic voice within the HRA

- we publish equality information annually, which includes the representation of disabled staff within the organisation – this data is collected at the application stage and pulled through to our employee records system, where it can be updated at any time

Equality information for staff

|

31 March 2025 Number |

31 March 2025 % |

31 March 2024 Number |

31 March 2024 % |

|

| Gender | ||||

| Female | 182 | 70% | 187 | 72% |

| Male | 78 | 30% | 73 | 28% |

|

Grand total |

260 | 100% | 260 | 100% |

|

Ethnic Origin (Grouped) |

||||

| Asian or British Asian | 23 | 9% | 23 | 9% |

|

Black or Black British / Mixed / Other ethnic group |

21 | 8% | 20 | 8% |

| Not stated / undefined | 12 | 5% | 10 | 4% |

| White | 204 | 78% | 207 | 79% |

|

Grand total |

260 | 100% | 260 | 100% |

| Disabled | ||||

| No | 208 | 80% | 219 | 84% |

| Not declared / undefined | 16 | 6% | 13 | 5% |

| Yes | 36 | 14% | 28 | 11% |

|

Grand total |

260 | 100% | 260 | 100% |

| Age | ||||

| <20-25 | 4 | 2% | 4 | 2% |

| 26-35 | 69 | 26% | 81 | 31% |

| 36-45 | 99 | 38% | 91 | 35% |

| 46-55 | 62 | 24% | 58 | 22% |

| 56-75 | 26 | 10% | 26 | 10% |

|

Grand total |

260 | 100% | 260 | 100% |

|

31 March 2025 |

||||

| Male | % | Female | % | |

| Directors | 1 | 20% | 4 | 80% |

|

Other senior managers |

24 | 42% | 33 | 58% |

| Employees | 53 | 27% | 145 | 73% |

| Total | 78 | 30% | 182 | 70% |

| 31 March 2024 | ||||

| Directors | Male | % | Female | % |

|

Other senior managers |

1 | 20% | 4 | 80% |

| Employees | 22 | 39% | 35 | 61% |

| Total | 50 | 25% | 148 | 75% |

| 73 | 28% | 187 | 72% |

We publish gender pay information showing the difference in average earnings between women and men. It is pleasing to see that the gap has reduced this year compared to previous years. The results for 2025 show that the average hourly rate is 5.1% higher for men, with the median being 2.6% higher (2024 average hourly rate 6.0% higher, and median 14.6% higher). This does not mean that men get paid more than women for doing the same job, the NHS pay grade structure (also known as Agenda for Change) and employment practices we use mean this is not possible.

It’s good to see that this year’s results are an improvement on previous years as we work towards removing this gap. To do this, we have developed actions to address these differences and to further close this gap.

We publish diversity information on the HRA website.

Our gender pay gap data is also published on the gov.uk website.

Freedom to speak up (raising concerns)

Our freedom to speak up policy is derived from the Public Interest Disclosure Act 1998 (PIDA) which exists to protect members of staff who make disclosures in good faith about wrongdoing or activity which is against the public interest. The policy is made available to all staff and is published on our SharePoint. There were no freedom to speak up claims during 2024-25 and 2023-24.

Health, safety and welfare

We embrace health, safety and welfare as an integral part of our culture. We are committed to the fundamental right of all staff to work in a safe and healthy environment, and to an integrated approach to identifying and mitigating associated risks.

Managers and staff are supported by comprehensive health, safety and welfare arrangements including an Estates Strategy Group which incorporates our Health, Safety and Welfare Committee (HSWC), comprehensive policies and procedures and access to expert advice. We encourage our employees to report accidents or instances of work-related ill health so we can identify trends and to inform on our health and safety performance.

We are pleased to report that we have had no reportable incidents, the same as last year. The HSWC is satisfied that if an incident were to occur it would be known immediately and reported.

No reports were made under Reporting Injuries, Diseases and Dangerous Occurrences Regulations 2013.

Trade union recognition

We have a well-established and embedded staff forum (Staff Voices) and a formal partnership with Unison and Managers in Partnership. The Joint Negotiating Committee has formally met 4 times. During the year 7 members of staff (7 FTE) were union officials at the HRA.

| Percentage time | Number of employees |

| 0% | 1 |

| 1-50% | 6 |

| 51-99% | 0 |

| 100% | 0 |

| Percentage of staff costs spend on union facility activities | Spend information |

|

Total cost of union facility activities |

£6,088 |

|

Total staff costs |

£15,274,290 |

|

Percentage of total staff costs spend on union facility activities |

0.04% |

|

Paid trade union activities |

|

|

Time spent on paid trade union activities as a percentage of total paid facility time hours |

100% |

Pension Liabilities

Past and present employees of the HRA are covered by the provisions of the NHS Pensions Scheme. Page 56 of the annual report presents how pension liabilities have been treated.

Parliamentary accountability and audit report

This section provides other information disclosed in the public interest and is subject to audit.

Remote Contingent Liabilities

There are no known material remote contingent liabilities.

Regularity of Expenditure: Losses and Special Payments

For the year ending 31 March 2025 the Health Research Authority incurred 21 losses totalling £5,677 (2023-24: 16 losses totalling £151,280).

No special payments were made during the year.

Dr Matthew Westmore

Chief Executive

Health Research Authority

11 July 2025

The certificate and report of the Comptroller and Auditor General to the Houses of Parliament

Opinion on financial statements

I certify that I have audited the financial statements of the Health Research Authority for the year ended 31 March 2025 under the Care Act 2014.

The financial statements comprise the Health Research Authority’s

- Statement of Financial Position as at 31 March 2025;

- Statement of Comprehensive Net Expenditure, Statement of Cash Flows and Statement of Changes in Taxpayers’ Equity for the year then ended; and

- the related notes including the significant accounting policies.

The financial reporting framework that has been applied in the preparation of the financial statements is applicable law and UK adopted International Accounting Standards.

In my opinion, the financial statements:

Opinion on regularity

In my opinion, in all material respects, the income and expenditure recorded in the financial statements have been applied to the purposes intended by Parliament and the financial transactions recorded in the financial statements conform to the authorities which govern them.

Basis for opinions

I conducted my audit in accordance with International Standards on Auditing (UK) (ISAs UK), applicable law and Practice Note 10 Audit of Financial Statements and Regularity of Public Sector Bodies in the United Kingdom (2024). My responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of my certificate.

Those standards require me and my staff to comply with the Financial Reporting Council’s Revised Ethical Standard 2019. I am independent of the Health Research Authority in accordance with the ethical requirements that are relevant to my audit of the financial statements in the UK. My staff and I have fulfilled our other ethical responsibilities in accordance with these requirements.

I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion.

Conclusions relating to going concern

In auditing the financial statements, I have concluded that the Health Research Authority’s use of the going concern basis of accounting in the preparation of the financial statements is appropriate.

Based on the work I have performed, I have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the Health Research Authority’s ability to continue as a going concern for a period of at least twelve months from when the financial statements are authorised for issue.

My responsibilities and the responsibilities of the Accounting Officer with respect to going concern are described in the relevant sections of this certificate.

The going concern basis of accounting for the Health Research Authority is adopted in consideration of the requirements set out in HM Treasury’s Government Financial Reporting Manual, which requires entities to adopt the going concern basis of accounting in the preparation of the financial statements where it is anticipated that the services which they provide will continue into the future.

Other Information

The other information comprises information included in the Annual Report, but does not include the financial statements and my auditor’s certificate and report thereon. The Accounting Officer is responsible for the other information.

My opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in my certificate, I do not express any form of assurance conclusion thereon.

My responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or my knowledge obtained in the audit, or otherwise appears to be materially misstated.

If I identify such material inconsistencies or apparent material misstatements, I am required to determine whether this gives rise to a material misstatement in the financial statements themselves. If, based on the work I have performed, I conclude that there is a material misstatement of this other information, I am required to report that fact.

I have nothing to report in this regard.

Opinion on other matters

In my opinion the part of the Remuneration and Staff Report to be audited has been properly prepared in accordance with Secretary of State directions issued under the Care Act 2014.

In my opinion, based on the work undertaken in the course of the audit:

- the parts of the Accountability Report subject to audit have been properly prepared in accordance with Secretary of State directions made under the Care Act 2014; and

- the information given in the Performance and Accountability reports for the financial year for which the financial statements are prepared is consistent with the financial statements and is in accordance with the applicable legal requirements.

Matters on which I report by exception

In the light of the knowledge and understanding of the Health Research Authority and its environment obtained in the course of the audit, I have not identified material misstatements in the Performance Report and Accountability Report.

I have nothing to report in respect of the following matters which I report to you if, in my opinion:

- adequate accounting records have not been kept by the Health Research Authority or returns adequate for my audit have not been received from branches not visited by my staff; or

- I have not received all of the information and explanations I require for my audit; or

- the financial statements and the parts of the Accountability Report subject to audit are not in agreement with the accounting records and returns; or

- certain disclosures of remuneration specified by HM Treasury’s Government Financial Reporting Manual have not been made or parts of the Remuneration and Staff Report to be audited are not in agreement with the accounting records and returns; or

- the Governance Statement does not reflect compliance with HM Treasury’s guidance.

Responsibilities of the Accounting Officer for the financial statements

As explained more fully in the Statement of Accounting Officer’s Responsibilities, the Accounting Officer is responsible for:

- maintaining proper accounting records;

- providing the C&AG with access to all information of which management is aware that is relevant to the preparation of the financial statements such as records, documentation and other matters;

- providing the C&AG with additional information and explanations needed for his audit;

- providing the C&AG with unrestricted access to persons within the Health Research Authority from whom the auditor determines it necessary to obtain audit evidence;

- ensuring such internal controls are in place as deemed necessary to enable the preparation of financial statements to be free from material misstatement, whether due to fraud or error;

- preparing financial statements which give a true and fair view in accordance with Secretary of State directions issued under the Care Act 2014;

- preparing the annual report, which includes the Remuneration and Staff Report, in accordance with Secretary of State directions issued under the Care Act 2014; and

- assessing the Health Research Authority’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the Accounting Officer anticipates that the services provided by the Health Research Authority will not continue to be provided in the future.

Auditor’s responsibilities for the audit of the financial statements

My responsibility is to audit, certify and report on the financial statements in accordance with the Care Act 2014.

My objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue a certificate that includes my opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

Extent to which the audit was considered capable of detecting non-compliance with laws and regulations including fraud

I design procedures in line with my responsibilities, outlined above, to detect material misstatements in respect of non-compliance with laws and regulations, including fraud. The extent to which my procedures are capable of detecting non-compliance with laws and regulations, including fraud is detailed below.

Identifying and assessing potential risks related to non-compliance with laws and regulations, including fraud

In identifying and assessing risks of material misstatement in respect of non- compliance with laws and regulations, including fraud, I:

- considered the nature of the sector, control environment and operational performance including the design of the Health Research Authority’s accounting policies and key performance indicators.

- inquired of management, the Health Research Authority’s head of internal audit and those charged with governance, including obtaining and reviewing supporting documentation relating to the Health Research Authority’s policies and procedures on:

- identifying, evaluating and complying with laws and regulations;

- detecting and responding to the risks of fraud; and

- the internal controls established to mitigate risks related to fraud or non- compliance with laws and regulations including the Health Research Authority’s controls relating to the Health Research Authority’s compliance with the Care Act 2014 and Managing Public Money.

- inquired of management, the Health Research Authority’s head of internal audit and those charged with governance whether:

- they were aware of any instances of non-compliance with laws and regulations;

- they had knowledge of any actual, suspected, or alleged fraud;

- discussed with the engagement team regarding how and where fraud might occur in the financial statements and any potential indicators of fraud.

As a result of these procedures, I considered the opportunities and incentives that may exist within the Health Research Authority for fraud and identified the greatest potential for fraud in the following areas: revenue recognition, posting of unusual journals including journals to manipulate expenditure in order to reduce underspend, complex transactions, and bias in management estimates including the apportionment of costs between revenue and capital with respect of the capitalisation of the research systems programme. In common with all audits under ISAs (UK), I am required to perform specific procedures to respond to the risk of management override.

I obtained an understanding of the Health Research Authority’s framework of authority and other legal and regulatory frameworks in which the Health Research Authority operates. I focused on those laws and regulations that had a direct effect on material amounts and disclosures in the financial statements or that had a fundamental effect on the operations of the Health Research Authority. The key laws and regulations I considered in this context included the Care Act 2014, Managing Public Money, and employment law.

Audit response to identified risk

To respond to the identified risks resulting from the above procedures:

- I reviewed the financial statement disclosures and testing to supporting documentation to assess compliance with provisions of relevant laws and regulations described above as having direct effect on the financial statements;

- I enquired of management and the Audit and Risk Committee concerning actual and potential litigation and claims;

- I reviewed minutes of meetings of those charged with governance and the Board and internal audit reports;

- I addressed the risk of fraud through management override of controls by testing the appropriateness of journal entries and other adjustments; assessing whether the judgements on estimates are indicative of a potential bias; assessing the apportionment of expenditure between capital and revenue with respect to the internally generated intangible asset capitalised in the year; and evaluating the business rationale of any significant transactions that are unusual or outside the normal course of business

I communicated relevant identified laws and regulations and potential risks of fraud to all engagement team members and remained alert to any indications of fraud or non-compliance with laws and regulations throughout the audit.

A further description of my responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at: www.frc.org.uk/auditorsresponsibilities. This description forms part of my certificate.

Other auditor’s responsibilities

I am required to obtain sufficient appropriate audit evidence to give reasonable assurance that the expenditure and income recorded in the financial statements have been applied to the purposes intended by Parliament and the financial transactions recorded in the financial statements conform to the authorities which govern them.

I communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control I identify during my audit.

Report

I have no observations to make on these financial statements.

Gareth Davies Date 15 July 2025

Comptroller and Auditor General

National Audit Office

157-197 Buckingham Palace Road Victoria

London SW1W 9SP